I am a research advisor at the the Bank of England (Disclaimer: all views expressed here, including the blog, are my own and cannot not under any circumstances be connected to or represented as those of the Bank of England). My work focuses on the application of models from statistical learning (often called machine learning), the use of novel data source, e.g. new micro or unstructured data, and how these techniques can be best used to inform public policy decisions.

I also think that economics, especially macroeconomics, should take real-world complexities, such as distributions, the interactions of potentially many actors or behavioural processes, better into account. On the up side, this is happening more and more, where some of my colleagues made early steps into this direction. Parts of my own work focuses on networks, learning agents and making connections between public perception and economic outcomes.

More generally, I am an advocate of greater public engagement in public decisions, where modern technology and analytical tools can help us to distil useful signals from the disparate views and experiences of individuals in society. Please see “The Public Economist” for an example of how such information could be used, and the Bank of England Citizens’ Forum for one such approach more generally.

Below is a list of selected projects and publications (updated: Nov 2023). Comprehensive lists are on my Google Scholar profile. Some old CV. There should be an open-access version of all of them, e.g. a working paper. Feel free to contact me if you hit a paywall.

Credit growth, the yield curve and financial crisis prediction: evidence from a machine learning approach by Kristina Bluwstein, Marcus Buckmann, AJ, Sujit Kapadia and Oezguer Simsek (Journal of International Econommics, forthcoming, link, code)

Absract: We develop early warning models for financial crisis prediction applying machine learning techniques on macrofinancial data for 17 countries over 1870-2016. Most nonlinear machine learning models outperform logistic regression in out-of-sample predictions and forecasting. We identify economic drivers of our machine learning models using a novel framework based on Shapley values, uncovering nonlinear relationships between the predictors and crisis risk. Throughout, the most important predictors are credit growth and the slope of the yield curve, both domestically and globally. A flat or inverted yield curve is of most concern when nominal interest rates are low and credit growth is high.

All You Need is Cash: Corporate Cash Holdings and Investment after the Financial Crisis by AJ, Christiane Kneer & Neeltje van Horen (Review of Finance, R&R, link)

Abstract: This paper studies how cash holdings at the onset of the global financial crisis afffected the investment behavior of SMEs after the shock. We use balance sheet data for a large sample of UK SMEs and introduce a novel identification strategy exploiting the volatility of cash holdings to reduce endogeneity concerns. We find that cash holdings are a key determinant of investment by SMEs not only during the crisis but also during the recovery period. Cash-rich SMEs could maintain their capital stock during the global financial crisis, while cash-poor rivals reduced theirs. This gave cash-rich SMEs an advantage when the economy rebounded, resulting in a persistent investment gap which grew over the seven years following the shock. The amplification effect was particularly pronounced for youngerand smaller firms and in industries where credit conditions tightened more. Competition dynamics and borrowing constraints seem to drive this amplification effect.

Parametric inference with universal function approximators by AJ (arXiv pre-print, link)

Universal function approximators, such as artificial neural networks, can learn a large variety of target functions arbitrarily well given sufficient training data. This flexibility comes at the cost of the ability to perform parametric inference. We address this gap by proposing a generic framework based on the Shapley-Taylor decomposition of a model. A surrogate parametric regression analysis is performed in the space spanned by the Shapley value expansion of a model. This allows for the testing of standard hypotheses of interest. At the same time, the proposed approach provides novel insights into statistical learning processes themselves derived from the consistency and bias properties of the nonparametric estimators. We apply the framework to the estimation of heterogeneous treatment effects in simulated and real-world randomised experiments. We introduce an explicit treatment function based on higher-order Shapley-Taylor indices. This can be used to identify potentially complex treatment channels and help the generalisation of findings from experimental settings. More generally, the presented approach allows for a standardised use and communication of results from machine learning models.

An interpretable machine learning workflow with an application to economic forecasting by Marcus Buckmann & AJ (International Journal of Central Banking, forthcoming, link, code)

We propose a generic workflow for the use of machine learning models to inform decision making and to communicate modelling results with stakeholders. It involves three steps: (1) a comparative model evaluation, (2) a feature importance analysis and (3) statistical inference based on Shapley value decompositions. We discuss the different steps of the workflow in detail and demonstrate each by forecasting changes in US unemployment one year ahead using the well-established FRED-MD dataset. We find that universal function approximators from the machine learning literature, including gradient boosting and artificial neural networks, outperform more conventional linear models. This better performance is associated with greater flexibility, allowing the machine learning models to account for time-varying and nonlinear relationships in the data generating process. The Shapley value decomposition identifies economically meaningful nonlinearities learned by the models. Shapley regressions for statistical inference on machine learning models enable us to assess and communicate variable importance akin to conventional econometric approaches. While we also explore high-dimensional models, our findings suggest that the best trade-off between interpretability and performance of the models is achieved when a small set of variables is selected by domain experts.

Forecasting UK inflation bottom up by AJ, Eleni Kalamara, Galina PotjagailoChiranjit Chakraborty and George Kapetanios (International Journal of Forecasting, R&R, link)

We forecast CPI inflation in the United Kingdom up to one year ahead using a large set of monthly disaggregated CPI item series and a wide set of forecasting tools, including dimensionality reduction techniques, shrinkage methods, and non-linear machine learning models. We find that over the full sample period 2002–21, the Ridge regression combined with CPI item series yields substantial improvement against an autoregressive benchmark at the six-month horizon, whereas the benchmark is hard to beat with other models and for other horizons. However, when considering periods of time where aggregate CPI inflation measures exhibit changes in momentum (rising or falling) or tail values, a wide range of models leads to substantial significant relative forecast gains. Exploiting CPI items through shrinkage methods yields strongest gains at horizons of 6–12 months when headline and core inflation measures are rising or falling. At shorter horizons and when inflation is rising, machine learning tools combined with CPI items and macroeconomic indicators are more useful. We also provide a model-agnostic approach based on model Shapley value decompositions to interpret and communicate signals from groups of items according to interpretable CPI categories.

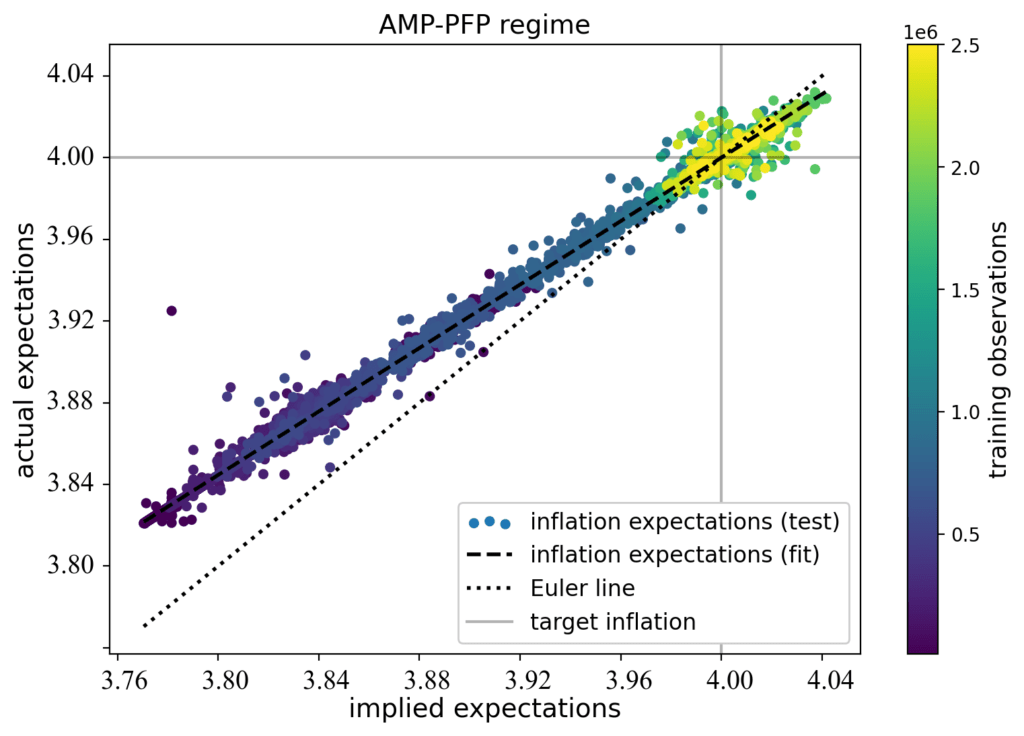

Deep Reinforcement Learning in a Monetary Model by Mingli Chen, AJ, Michael Kumhof, Xinlei Pan, Xuan Zhou (arXiv pre-print, link)

We propose using deep reinforcement learning to solve dynamic stochastic general equilibrium models. Agents are represented by deep artificial neural networks and learn to solve their dynamic optimisation problem by interacting with the model environment, of which they have no a priori knowledge. Deep reinforcement learning offers a flexible yet principled way to model bounded rationality within this general class of models. We apply our proposed approach to a classical model from the adaptive learning literature in macroeconomics which looks at the interaction of monetary and fiscal policy. We find that, contrary to adaptive learning, the artificially intelligent household can solve the model in all policy regimes.

The public economist: learning from our Citizens’ Panels about the UK economy by AJ, Jenny Lam and Michael McMahon (Bank of England Quarterly Bulletin, link)

Since 2018, our Citizens’ Panels have helped us to understand how people think and feel about the economy. This article considers the results from our Citizens’ Panels survey and first public forecasting competition. The main event during the survey period was the outbreak of the Covid-19 (Covid) pandemic. Panellists provided early information on the Covid pandemic, their responses can help to forecast macroeconomic indicators, such as changes in present and expected consumer prices and unemployment.

OTC Microstructure in a period of stress: A Multi-layered network approach by AJ and Michalis Vasios (Journal of Banking and Finance, link)

How does the microstructure of an over-the-counter market respond in a time of stress? We test several hypotheses of network-based models by analysing the 2015 crash of the Swiss franc-euro FX derivatives market. To do so we employ unique data at transaction and counterparty identity level, and a new analytical framework that uses the trading network topology to segment the market into a multi-layered structure. We document limited intermediation by inner-core nodes, in particular dealers with loss making outstanding positions. Clients in greater need of trading were less likely to trade, pointing to a supply driven liquidity shortage. However, more central and better connected clients were able to access the market sooner and at better prices than more peripheral clients, lending support to theory predictions that network centrality matters for sourcing liquidity and execution quality.

Cross-border Portfolio Investment Networks and Indicators for Financial Crises by AJ, Stephan Joseph and Guanrong Chen (Nature Scientific Reports, link)

Cross-border equity and long-term debt securities portfolio investment networks are analysed from 2002 to 2012, covering the 2008 global financial crisis. They serve as network-proxies for measuring the robustness of the global financial system and the interdependence of financial markets, respectively. Two early-warning indicators for financial crises are identified: First, the algebraic connectivity of the equity securities network, as a measure for structural robustness, drops close to zero already in 2005, while there is an over-representation of high-degree off-shore financial centres among the countries most-related to this observation, suggesting an investigation of such nodes with respect to the structural stability of the global financial system. Second, using a phenomenological model, the edge density of the debt securities network is found to describe and even forecast, the proliferation of several over-the-counter-traded financial derivatives, most prominently credit default swaps, enabling one to detect potentially dangerous levels of market interdependence and systemic risk.

Interactions between Financial and Environmental Networks in OECD Countries by Franco Ruzzenenti, AJ, Elisa Ticci, Pietro Vozzella, Giampaolo Gabbi (PLOS ONE, link)

We analysed a multiplex of financial and environmental networks between OECD countries from 2002 to 2010. Foreign direct investments and portfolio investment showing the flows in equity securities, short-term, long-term and total debt, these securities represent the financial layers; emissions of NOx, PM10, SO2, CO2 equivalent and the water footprint associated with international trade represent the environmental layers. We present a new measure of cross-layer correlations between flows in different layers based on reciprocity. For the assessment of results, we implement a null model for this measure based on the exponential random graph theory. We find that short-term financial flows are more correlated with environmental flows than long-term investments. Moreover, the correlations between reverse financial and environmental flows (i.e. the flows of different layers going in opposite directions) are generally stronger than correlations between synergic flows (flows going in the same direction). This suggests a trade-off between financial and environmental layers, where, more financialised countries display higher correlations between outgoing financial flows and incoming environmental flows than from lower financialised countries. Five countries are identified as hubs in this finance-environment multiplex: The United States, France, Germany, Belgium-Luxembourg and United Kingdom.